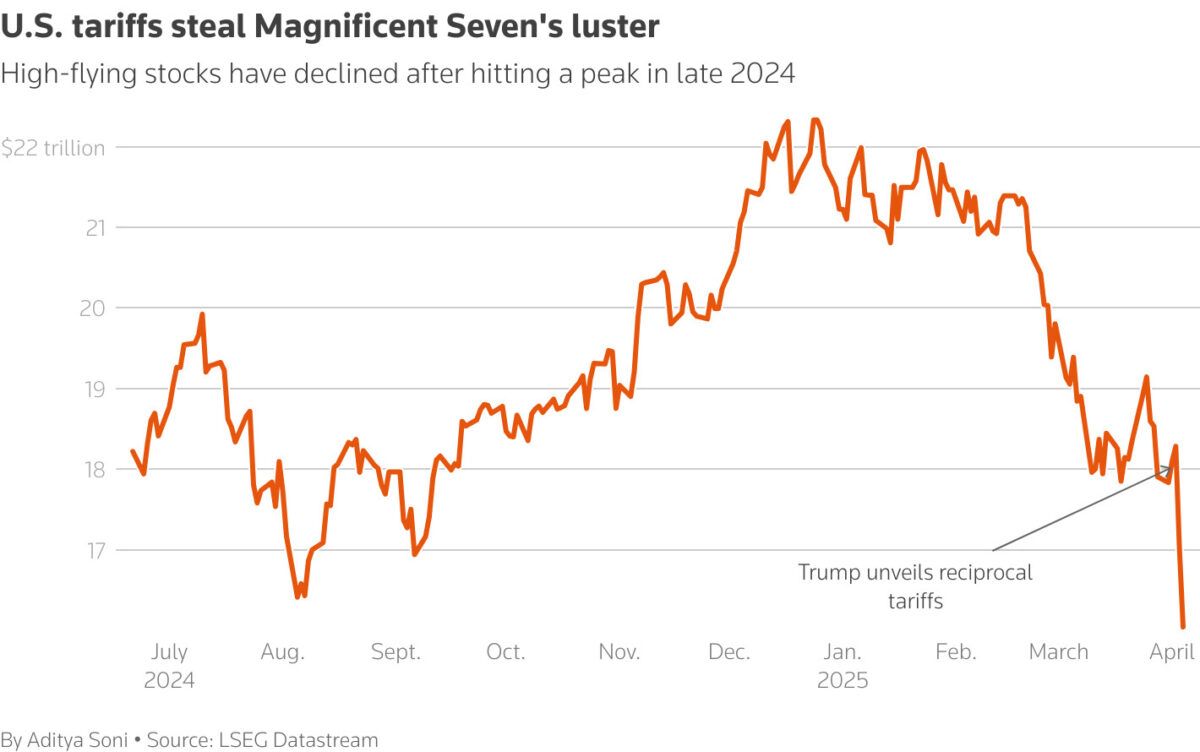

TL;DR – Two American titans are about to be smashed by Trump’s new tariffss

Elon Musk’s Tesla and Apple will be two of the worst-hit companies in Trump’s new Tariff-based America…

- Apple’s stock target was cut from $325 to $250 by Wedbush, with shares falling 4.3% in response.

- Tesla’s target was slashed from $550 to $315, reflecting concern over both tariffs and Musk’s political influence.

- Apple’s China-heavy supply chain puts it at major risk under new tariff policies.

- Tesla’s brand is losing traction overseas, particularly in China, as Musk’s public stance becomes more polarizing.

It’s been a rocky weekend for two of America’s most high-profile tech companies. Analyst Dan Ives from Wedbush Securities cut his price targets for both Apple and Tesla, pointing to a volatile mix of U.S. tariffs, global trade tensions, and political missteps from Tesla CEO Elon Musk.

Tariffs Take a Toll: Apple’s Deep China Ties Now a Liability

In a stark note to investors, Ives didn’t mince words: “The tariff economic Armageddon unleashed by Trump is a complete disaster for Apple.”

His warning centers on Apple’s heavy reliance on Chinese manufacturing — around 90% of iPhones are produced and assembled there.

That makes Apple extremely vulnerable to escalating U.S.-China trade tensions and import tariffs.

Because of this exposure, Wedbush has slashed its price target for Apple stock from $325 to $250 per share — a $75 drop.

Apple’s stock responded predictably: shares fell by 4.3% and were trading around $180 on Monday afternoon.

That’s not just a market wobble — it reflects serious concern about Apple’s ability to navigate what could be a long-term breakdown in U.S.-China economic relations.

With the iPhone 17 and new Macs on the horizon, supply chain headaches could come at the worst possible time.

Pro Tip: Looking for a way to save on an iPhone? Consider going with a refurbished model — you’ll save hundreds and still get years of iOS updates.

👉 Check out our guide to the best refurbished phones

Tesla Faces a Double Whammy: Tariffs and Musk’s Growing Brand Problem

Tesla’s issues run deeper than just trade. Ives cut Tesla’s price target from $550 to $315 — still optimistic compared to the company’s current price of around $234, but it’s a sharp revision that signals falling investor confidence.

Ives cited not just tariff-related concerns, but also a growing “brand crisis” fueled by CEO Elon Musk’s political associations and public behavior.

Musk’s support for Trump and his public endorsement of policies viewed unfavorably in key markets like Europe and China is now starting to impact Tesla’s sales and perception abroad.

“Tesla has essentially become a political symbol globally,” Ives wrote.

“It is time for Musk to step up, read the room, and be a leader in this time of uncertainty.”

That sentiment has been echoed by some longtime Tesla fans who feel the company is losing its progressive, forward-thinking brand identity.

In a market as nationalistic and competitive as China, Musk’s missteps may be pushing customers toward domestic rivals like BYD — one of the fastest-growing EV brands in the world.

Tesla shares dropped nearly 10% after the news, although they did show signs of recovery Monday afternoon.

What’s Really at Stake Here?

This isn’t just a temporary stock blip. Apple and Tesla are both facing structural challenges:

- For Apple, the risk lies in an over-dependence on China for production, something the company has been slowly diversifying but is far from resolving.

- For Tesla, it’s a combination of softening demand, rising global competition, and a CEO who may be alienating buyers in key markets.

Both companies are symbols of American tech innovation — and both now face serious questions about how they’ll navigate increasingly globalized (and politicized) markets.

FAQ

Why are Apple and Tesla being hit so hard by tariffs?

Apple relies on China for the vast majority of its iPhone production, while Tesla sells heavily in China and sources components from global suppliers. Tariffs increase costs and disrupt these supply chains.

Is Apple moving away from China for production?

Yes, Apple has been shifting some manufacturing to countries like India and Vietnam, but China remains its core hub for now.

Why is Elon Musk’s political stance affecting Tesla’s business?

Musk’s public alignment with controversial policies and figures has started to affect Tesla’s brand perception, especially in markets like China and the EU where consumer sentiment is shifting.

Should investors be worried about these changes?

Long-term investors should watch how both companies adapt. Apple’s supply chain strategy and Tesla’s global brand management are now critical risk areas.